Sales allowances are price reductions for goods customers keep but are dissatisfied with, like offering a discount for damaged items they agree to keep. Sales discounts do not reduce any assets or liabilities, only revenue which reduces net income. However, a company may decide to just simply record its net sales in its income statement, rather than reporting the sales discount and gross sales separately. This is normally common when the amount of sales discount is so small that a separate line item presentation does not yield any material additional information for the reader of the financial statement. Expenses and revenues are usually reported in a company’s income statements.

How to account for trade discounts

- The presentation of sales discounts also affects the statement of cash flows.

- This is one of the best ways most of the sellers could improve the cash flow for their operations.

- Quantity discounts are price reductions based on the volume of goods purchased.

- Thus, the net effect of the allowance technique is to recognize the estimated amount of the discount at once and park that amount in an allowance account on the balance sheet.

With the use of a contra-revenue account, the reader of the income statement will be able to differentiate between the original amount of sales revenue generated, the sales reduction, and the resulting net amount. Quantity discounts follow a similar accounting treatment to trade discounts. The sale is recorded at the net price after the discount, reflecting the actual revenue earned. For instance, if a customer buys 100 units at $10 each with a 5% discount, the journal entry would debit Accounts Receivable and credit Sales Revenue for $950. This method streamlines the accounting process and provides a clear picture of the revenue generated from sales. A contra revenue account that reports the discounts allowed by the seller if the customer pays the amount owed within a specified time period.

TaxJar для оптимизации учета налога с продаж

The customer received a 2 percent discount on the $100 for paying early, and as such will pay $98 instead of $100 (i.e $2 discount is subtracted from $100). In order to record this transaction, Company ABC’s Cash account would be debited by the amount of $98 cash received from the customer and the Sales discount account would be debited by the amount of $2 discount. The purpose of a business offering sales discounts is to encourage the customer to settle their account earlier (10 days instead of 30 days in the above example). By receiving payment earlier the business now has use of the cash for an extra 20 days and reduces the chances that the customer will eventually default. Sales discounts are recorded in a contra revenue account such as Sales Discounts.

Ask a Financial Professional Any Question

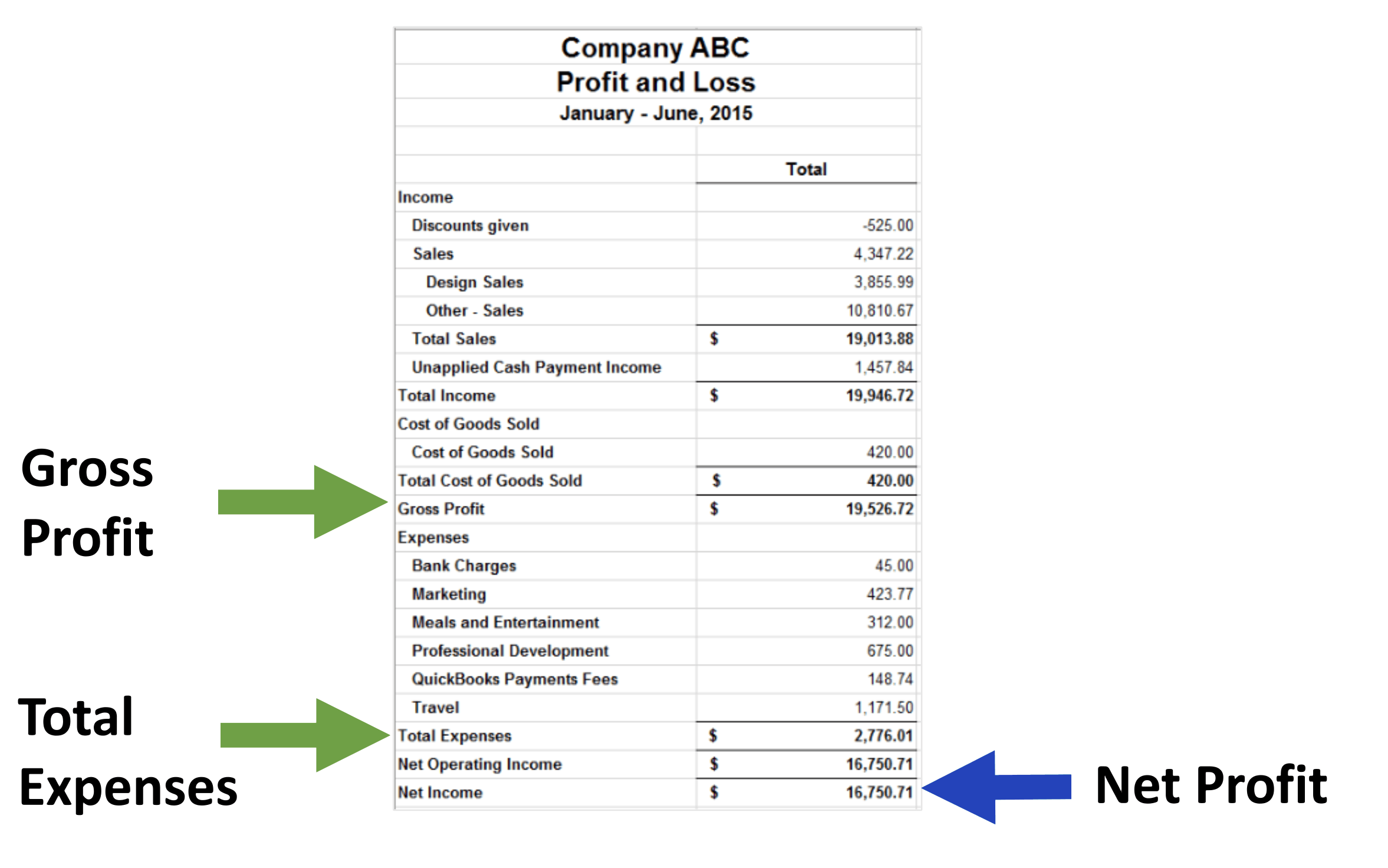

The seller usually states the standard terms under which a sales discount may be taken in the header bar of its invoices. Learn how to effectively manage and record sales discounts in accounting to optimize financial reporting and business performance. The sales discount will be shown in the company’s profit and loss statement for an accounting period below as the gross revenue of the company. Sales or Cash Discounts are properly recorded and shown in the financial statements. Revenue recognition with discounts requires a nuanced approach to ensure that the revenue is recorded accurately. The timing of when a discount is granted and when it is actually taken by the customer can affect when and how revenue is recognized.

The Statement of Profit or Loss (a.k.a. Income Statement using Canadian ASPE) shows the company’s earnings and expenses. Someone on our team will connect you with a financial is sales discount an expense professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible.

Accounting Ratios

Hence, the general ledger account Sales Discounts is a contra revenue account. The presentation of sales discounts also affects the statement of cash flows. Under the indirect method, changes in accounts receivable are adjusted in the operating activities section. When customers take cash discounts, the reduction in accounts receivable is reflected as an increase in cash flow from operating activities. This can provide a more favorable view of the company’s cash-generating ability, which is a critical factor for stakeholders assessing the company’s financial health. Therefore, companies that offer small discounts for a 10-day payment return are able to clear their accounts quickly.

Alternatively, the net method records the sale at the discounted amount initially, adjusting if the discount is not taken. Moreover, the treatment of sales discounts influences the accounts receivable balance on the balance sheet. When cash discounts are offered and taken by customers, the accounts receivable balance decreases more quickly, improving the company’s liquidity position.

Thus, the net effect of the allowance technique is to recognize the estimated amount of the discount at once and park that amount in an allowance account on the balance sheet. Then, when the customer actually takes the discount, you charge it against the allowance, thereby avoiding any further impact on the income statement in the later reporting period. The more liquid the underlying assets of the entity, the lower the discount of lack of marketability and vice versa.

However, as customers take advantage of the sales discount, the overall revenue figures for the business tend to reduce. This sacrifice is, nonetheless, done by businesses in order to encourage early payments and reduce bad debt. In addition, early payments support the liquidity position of the company and reduce the company’s outstanding accounts receivable.