- Setting up a payment bundle who give your own missed repayments over a designated quantity of months, that will increase your payment until the overlooked forbearance costs was basically fully paid back and you will would-be centered on your capability to result in the brand new monthly obligations.

- Stretching the term of one’s loan for the majority amount of time to blow right back the new overlooked repayments. Such as for example, in the event the offered a half a dozen-few days months where you cannot make a mortgage percentage, the home loan servicer can also add six months off payments to the time if the loan is placed as paid off (this new maturity big date). This could be one types of that loan modification.

- Modifying your loan to catch within the overlooked money over time thanks to a designated modification system supplied by who owns the financing.

Loan providers may also reveal that your particular loan isnt instantaneously federally backed and that doesn’t qualify for CARES Work forbearance

Note: People loan modification just after the forbearance identity will most likely require the servicer so you can file your revenue and you can expenditures to ensure your be considered to own an amendment program. The latest servicer tend to get in touch with you about it ahead of the prevent of the forbearance period.

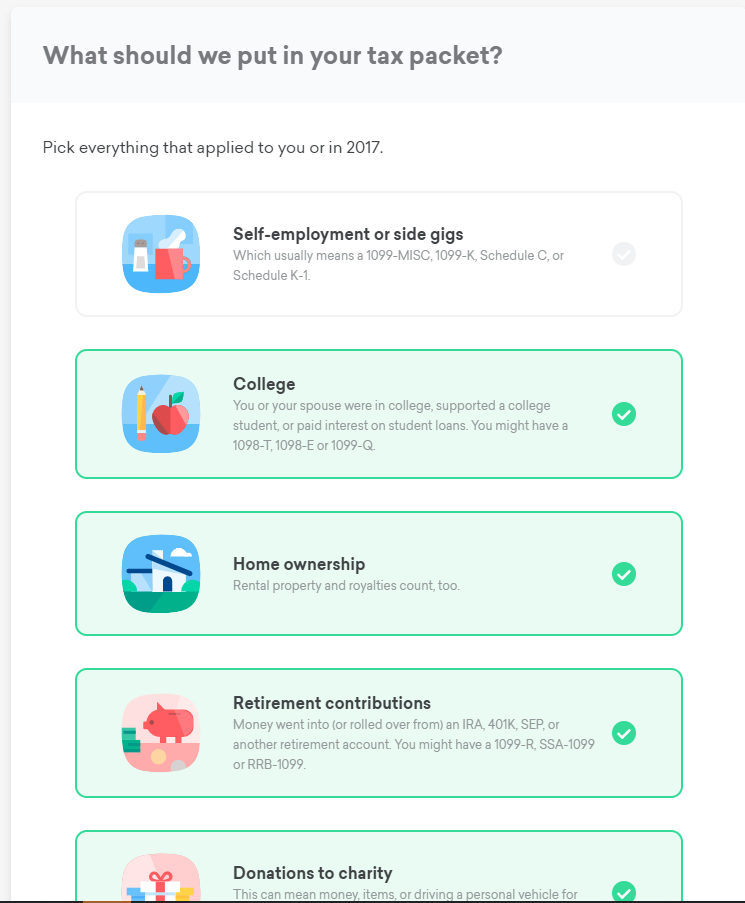

You need to strategy a beneficial forbearance which works for you. To prepare to-name the financial servicer getting a beneficial forbearance demand, you will want to collect your bank account recommendations. You could potentially review in public places offered financial servicer name texts so as that you will understand the kinds of concerns the servicer will get ask when revealing forbearance having youmonly utilized call programs and you will financing files include:

- Fannie mae Forbearance Phone call Software: Hook

- Freddie Mac computer COVID-19 Label Program: Link

- FHA COVID-19 Inquiries and you can Solutions: Hook up

- Virtual assistant Circular twenty six-20-12: Hook up

The decision to Demand Forbearance

In the event your loan is approved for save and you’re having monetaray hardship because of COVID-19, you are eligible to straight down repayments or forbearance that is offered on the CARES Act. When you’re nonetheless able to make your full monthly payment, you can want to continue doing this just like the appeal will continue to expand given that arranged and ultimately have to pay off the new amount of one forbearance.

When revealing forbearance with your financial servicer, be sure to speak about the cost available options to you prior to typing good forbearance system. Cost selection may differ dependent on the loan type of, and you will learn before typing forbearance how you would feel likely to pay back your paused repayments.

For folks who and your servicer disagree towards forbearance relief alternatives, please remember the CARES Work entitles that a beneficial forbearance of up to 180 weeks at your demand, and you can an extension off an additional 180 months at your demand. Keep detail by detail notes in your conversations and check one paperwork delivered by the servicer to make urgent hyperlink sure the newest terms of your forbearance are clear.

Mortgage lenders are requiring brand new consumers so you can indication COVID Attestations in the closure verifying that money has not yet altered and that they are not aware of coming changes in work or perhaps the you need so you’re able to demand forbearance.

Such attestations do not limit your rights under the CARES Operate once the revealed over. Although not, it could be correct that your loan is not immediately federally recognized which will not meet the requirements beneath the CARES Work up to it becomes federally backed, that will just take days or perhaps in some cases days.

This does not mean which you usually do not consult forbearance pointers and you can of numerous lenders and you may servicers offer forbearance professionals aside from federally backed reputation. When you have recently finalized towards financing and you will already come across oneself in need, you really need to speak to your servicer to determine the choices.