Exactly how a home collateral mortgage works

Because household security money are completely separate from your own home loan, the borrowed funds terminology to suit your amazing mortgage will remain unchanged. Shortly after closing your house equity loan, your own lender offers a lump sum payment. This lump sum payment you are anticipated to pay-off, usually on a fixed rate.

To have a house guarantee loan, it is unusual one a lender assists you to use 100% of guarantee. Although it may differ according to financial, the most that you can acquire is normally anywhere between 75% in order to ninety% of the worth of the house or property.

Particularly an earnings-away re-finance, the amount as possible acquire usually relies on their credit get, the loan-to-well worth (LTV) ratio, your debt-to-earnings (DTI) ratio, and other points.

I’ve explored the differences ranging from a funds-out refinance vs. property guarantee mortgage, now let us look into the similarities.

- Almost instantaneous currency. You to resemblance between the two is you found your bank account almost instantly. Whether you’re bringing property collateral mortgage or an earnings-aside refinance, you will located a lump sum payment within this about three working days when you intimate.

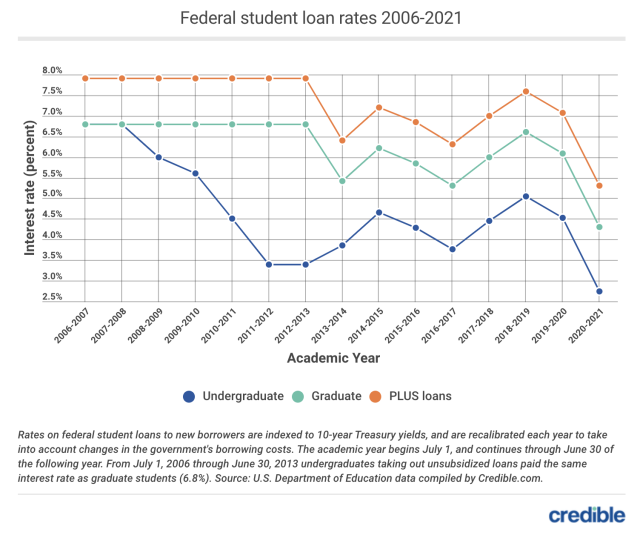

- Borrow against guarantee. You borrow against the new equity of your property. With each other household equity money and money-out refinances, you employ your residence since guarantee. It means, compared to other kinds of financing, you should buy lower rates of interest to possess house collateral finance and you can cash-away refinances.

- Under 100% guarantee. Generally speaking, you can’t get 100% equity from your home. Extremely loan versions and you may lenders identify that you have to exit some equity in the possessions.

Could it possibly be far better enjoys family security or bucks?

Both household guarantee fund and money-out refinances is proper a means to supply the latest collateral you’ve got accumulated of your house. Should it be best to has actually household collateral otherwise dollars tend to depend on your current financial situation and your financial desires.

Select the newest certification criteria for either solution. This will help you figure out which that youre likely to be to track down approved for.

On the one-hand, property guarantee mortgage would-be higher for those who have an excellent solid credit rating and wish to take out more substantial, fixed lump sum. A money-aside re-finance, on the other hand, could be the smart solution when you need to lower your mortgage repayment. In addition makes you pull funds from their guarantee by using one financing device.

Let us look closer during the when it might be much more great for explore a profit-aside refinance compared to home equity loan:

When to play with dollars-away re-finance

A cash-out re-finance may make the most experience for you if the value of has grown or if you have gathered security throughout the years by creating costs. A cash-aside refinance are a low-focus way of credit money you need for debt consolidation reduction, home improvements, university fees, or other expenses. This means, when you payday loan Anniston yourself have biggest expenditures you want to borrow money for, cash-out refinancing will be a powerful way to pay money for the individuals costs when you find yourself minimizing the attention.

When to fool around with property guarantee financing

A house equity loan makes sense if refinancing your mortgage perform lead you to get a considerably high rate of interest. But keep in mind that the large interest which comes with home guarantee financing is almost certainly not worth it often. It is advisable to calculate in advance to decide if a property equity mortgage produces financial sense to you. By way of example, you may find you to definitely a house security personal line of credit (HELOC) produces a great deal more sense.