Article Advice

Off repayments towards the residential property can vary commonly, which might succeed tough to recognize how far you’ll need to keep. Although not, if you are happy to pick a property, there are some lowest down payment guidance to follow. Some tips about what you must know prior to making a down-payment into the a property.

A down-payment try money you pay upfront towards the an effective house buy. Additionally, it is short for the very first ownership share at your home. Usually, it is conveyed given that a percentage of one’s total cost. Like, a good 10% downpayment for the a beneficial $400,000 family would be $forty,000.

When you’re ready to get property, you will likely want to make a down payment. Their lender will make it easier to funds the remainder of the fresh new cost when it comes to an interest rate .

There are lots of loan software which make it it is possible to so you can get a property without currency off , but not, and this we’ll protection after.

While making a beneficial 20% down-payment used to be believed the newest gold standard for selecting property, now, this really is only a benchmark that loan providers used to know if you prefer financial insurance policies. Usually from thumb, if you establish less than 20% for the a traditional financing , loan providers will demand you to definitely carry private financial insurance policies (PMI) .

Thank goodness, it’s not necessary to generate one highest from a down payment to acquire a home in the modern was only 8% getting very first-big date homebuyers , centered on investigation regarding Federal Organization off Real estate professionals (NAR). To possess recite consumers, the typical was 19%.

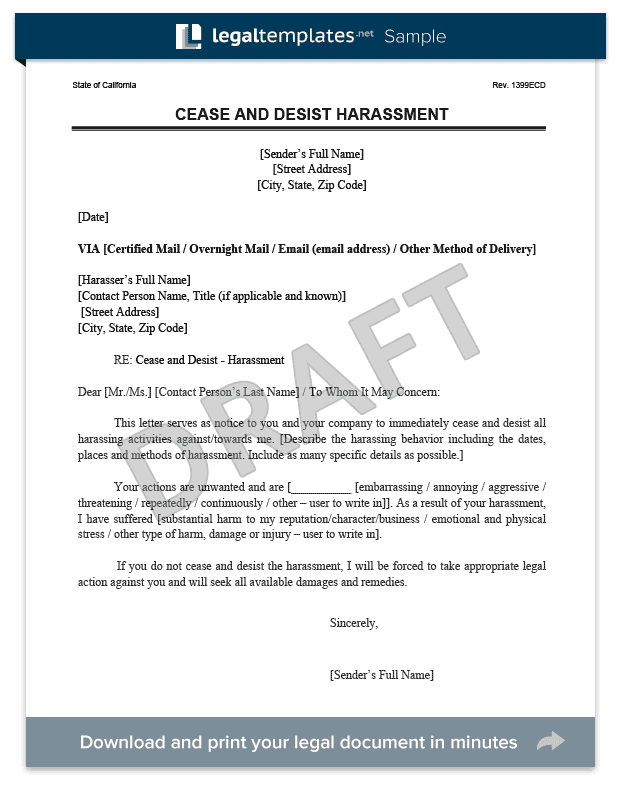

Homebuyers can get mistake how much cash they must set out to the good house or apartment with the minimum requirements place because of the lenders. This new table below also offers a brief go through the lowest matter needed for for each mortgage system.

Antique loans: 3% deposit

Some antique mortgage programs, like the Federal national mortgage association HomeReady mortgage and you may Freddie Mac computer Domestic Possible mortgage , accommodate off repayments only 3%, given you see certain earnings restrictions.

you will you desire a somewhat higher credit score. This new HomeReady loan requires the very least 620 score, because Domestic You’ll financing asks for about a great 660 score.

FHA money: 3.5% down payment

You can pay only step three.5% down that have that loan backed by the brand new Federal Houses Management (FHA) – for those who have no less than a beneficial 580 credit rating. The latest advance payment lowest into an FHA loan jumps in order to ten% if for example the credit history are anywhere between five hundred and you may 579.

Virtual assistant financing: 0% down payment

Qualified armed forces services users, veterans and you may enduring partners could possibly get a loan protected from the U.S. Company from Experts Situations (VA) with 0% down. When you’re there is no required lowest credit history to have an effective Virtual assistant loan , many lenders will get enforce their unique qualifying conditions.

USDA money: 0% deposit

The latest U.S. Company from Farming (USDA) even offers 0% deposit home loans so you’re able to qualified reasonable- and you will modest-earnings homeowners for the appointed outlying components. There’s no minimum https://paydayloanalabama.com/langston credit score necessary for a USDA mortgage , but the majority lenders expect you’ll pick no less than a beneficial 640 score.

Jumbo funds is finance that are larger than the brand new compliant loan constraints lay because of the Federal Housing Money Agencies (FHFA). Due to their dimensions, this type of funds can not be guaranteed by the Federal national mortgage association and you may Freddie Mac computer , the 2 agencies that give money for the majority of mortgage lenders.

Thus, these types of money are noticed riskier for loan providers, so you can commonly you would like more substantial down-payment is recognized.

Like any monetary decision, while making a large downpayment has its own positives and negatives. Let me reveal a peek at what to imagine one which just going.

Lower notice charge: As the you are borrowing from the bank quicker to purchase your domestic, you can spend all the way down appeal charges along side life of the loan. At the same time, lenders may give you a better rate of interest just like the they are going to see your while the a faster high-risk debtor.

Alot more equity: Your property guarantee is the part of your residence which you own downright. It’s mentioned by your home’s most recent worth without the matter your owe on your mortgage. The greater collateral you have got , the greater number of you might control so it advantage.

Less cash easily accessible: And come up with a larger downpayment often means you should have less money available to generate repairs or fulfill other economic goals, such as strengthening a crisis fund or coating required domestic repairs.

Expanded time and energy to help save: Getting down 20% can indicate that your discounts mission is fairly high. As a result, it will require lengthened to be a resident than for many who made a smaller sized down payment.

Long-identity experts: Many of the benefits associated with and also make a bigger downpayment is actually supposed to give you a hand in the long run. If you are not planning on residing in your house to possess an excellent if you are, you might not work with as frequently.

Just how much if you lay out on a house?

Sadly, there is absolutely no you to-size-fits-all cure for how much their advance payment is. It can count on the new specifics of the money you owe. Whatsoever, when you are there are various advantageous assets to and then make more substantial down-payment, spending way too much initial to own a house you will leave you feeling house-poor and you will struggling to subscribe their other economic goals.

You should fool around with different advance payment situations up to you property towards one that feels preferred for your requirements. When you find yourself just getting started examining the way to homeownership, our home cost calculator helps you decide what down payment is generally best for you.