House Equity Conversion process Home loan (HECM)

The new HECM is the most well-known contrary mortgage. HECMs is covered from the Government Construction Administration (FHA), that is region U.S. Institution out of Homes and you may Urban Advancement (HUD). The new FHA promises you to definitely lenders can meet their financial obligation. HECMs are merely provided by federally-accepted loan providers, who are needed to follow strict regulations imposed because of the federal authorities. This new FHA informs HECM loan providers simply how much they could provide you, centered on your actual age along with your house’s worth. Then, you must read opposite financial counseling just like the a disorder in order to obtaining these financing.

Single-Objective Opposite Mortgage loans

Repayments obtained as a result of this type of opposite mortgages can only be taken to possess specific objectives, such as domestic solutions, renovations, otherwise using possessions fees. These types of contrary mortgage loans are provided of the county and you will local governing bodies, otherwise nonprofit lenders, and they are the least expensive opposite mortgages. They are often only available in order to reduced-to-moderate-income residents.

Other “Proprietary” Reverse Mortgages

Some finance companies and you can creditors bring her contrary mortgage loans. Such funds try backed by the non-public companies that offer all of them; they may not be insured from the authorities.

- You and virtually any consumers towards the contrary mortgage have to be at the least 62 yrs . old.

- The home securing the reverse mortgage should be most of your quarters. Qualified property models include solitary-members of the family home, 24-unit holder-filled features, are designed belongings, condos, and you will townhouses.

- You need to often pay the outdated mortgage financial obligation before you score a face-to-face mortgage otherwise pay off the existing financial personal debt on money you get of an other mortgage.

The fresh investment, earnings, and you can credit conditions for a contrary mortgage are easier to meet than a normal mortgage since the an opposing mortgage will pay the fresh new borrower from the security in their home while you are a traditional financial means the newest borrower and make monthly home loan repayments.

However, all of the HECM opposite mortgages covered by FHA demand a recurring income or advantage requirement to make sure that the newest debtor making an application for an opposite mortgage gets enough income and info to fund recurring will set you back such as possessions taxes and you can homeowner’s insurance policies when you look at the opposite mortgage’s term. Similarly, most single-mission and propriety reverse mortgages have to have the borrower getting a beneficial certain quantity of money or possessions on the commission from assets taxation and you may insurance if you are the contrary home loan is actually effect.

Are there Charges Associated with Contrary Mortgages?

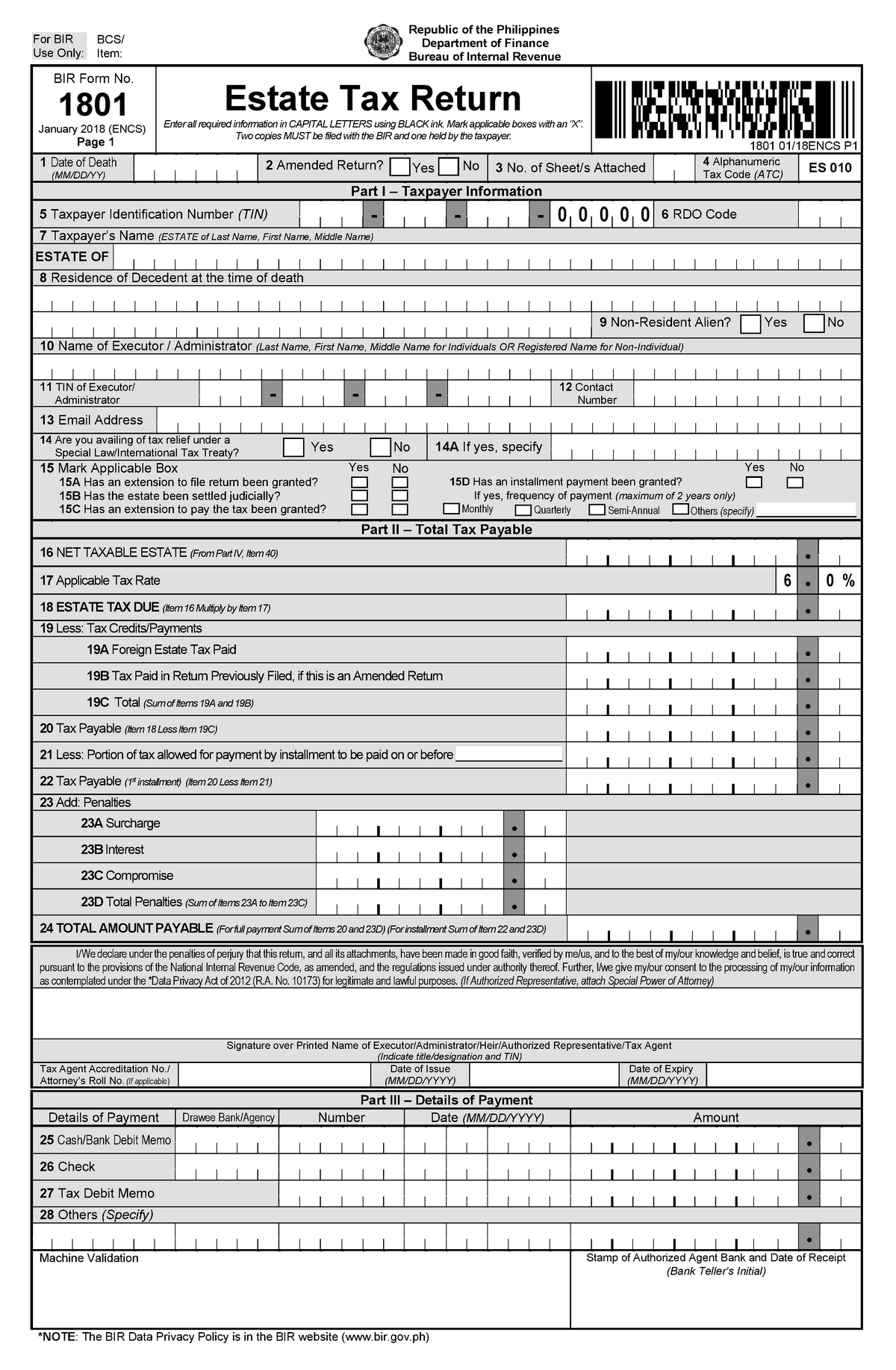

As with all mortgage loans, you’ll find will set you back and you can costs connected to protecting a face-to-face mortgage. Charge were those people of this mortgage origination, home loan insurance fees, settlement costs, and you may month-to-month upkeep charges. These types of charge are usually greater than brand new costs associated with the antique mortgages and you will domestic guarantee loans. Make sure to know the will cost you and costs of https://cashadvanceamerica.net/personal-loans/ the reverse financial.

Be aware that if you decide to funds the costs related that have an opposite financial, they will certainly boost your financing equilibrium and you can accrue notice for the life of the borrowed funds.

Can i Need certainly to Pay off the opposite Home loan?

You generally needn’t pay the reverse mortgage since the long since you and every other borrowers still are now living in your house, spend assets fees, look after home insurance, and keep the home in an effective resolve. The opposite lending company are normally taken for almost every other issues that can make your own opposite mortgage payable, therefore you should take a look at the loan records meticulously to be certain your understand most of the problems that can cause the loan being owed.

How much cash Am i going to Are obligated to pay When My personal Contrary Financial Will get Due?

Extent might owe on the reverse financial commonly equal most of the loan advances your acquired (as well as advances used to financing the borrowed funds or perhaps to pay-off previous personal debt), together with all interest you to accrued in your financing balance. Whether it number was lower than you reside worth whenever you only pay straight back the borrowed funds, then you (or their house) remain almost any number are left over.