Having fun with a business loan for rental property makes it possible to build a real estate portfolio by giving funds purchasing single or numerous leasing features and supply money getting renovations and you will enhancements in order to increase rental income.

You will find numerous financing choices for people, but looking a corporate loan for rent assets can occasionally be for example running into a brick wall. Unless, naturally, you understand where to look!

We’ll discuss the different team financing options available for rental possessions and you can speak about exactly how Small business Management (SBA) money are used for owning a home.

- A corporate financing for real estate was an alternative to acquiring a loan having a personal make certain.

- Of a lot lenders lay a great deal more focus on providers assets and the local rental assets used as collateral when underwriting a corporate financing.

- Supplies for rent assets business loans is finance companies with which a good company is currently conducting business and personal and collection loan providers.

- One or two mortgage programs provided by this new SBA to help a business purchase a property for its own have fun with are SBA 504 and you can SBA seven(a).

step 1. Old-fashioned loans from banks

When searching for a business financing to own a residential property, the first avoid is the bank otherwise credit partnership with which you are already doing business. Chances is that branch movie director and some of employees already know your by name and will greeting a chance to earn significantly more of your own business.

- Credit history demonstrating a track record of paying back fund promptly

- Financial statements in order to file incomes and prediction upcoming organization income

- Organization taxation statements proving the latest historical abilities of the providers given that stated on the Irs (IRS)

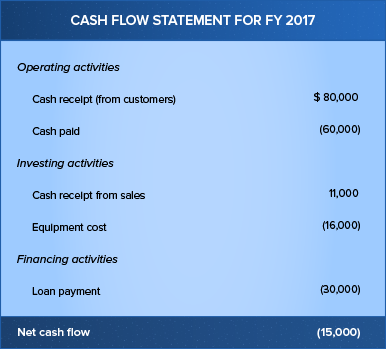

- Profit and loss declaration providing a loan provider having income and you may costs info more multiple periods

- Balance layer reporting newest possessions and debts exhibiting exacltly what the business possesses and you will owes, along with user’s security

- Business strategy and economic projections describing what the financing will be employed for, such as to shop for rental property, and money-circulate forecast demonstrating the loan is repaid

A loan provider may inquire about equivalent personal information and ask for an individual verify of organization principals, although your company is making an application for that loan.

dos. Team label mortgage

Traditional finance companies, credit unions, and private loan providers bring providers name financing. There are numerous title mortgage choices with various mortgage systems and you can interest rates. Label money to own enterprises offer fund to order gizmos, improve work place, and get a house. Money are obtained in one single lump sum payment and reduced more a time, generally having a predetermined interest.

Short-title loans, also known since the connection finance, normally have a fees term from one year otherwise less and you will could be a good idea for buying accommodations assets rapidly in advance of trying a vintage financial loan. Medium-label business loans routinely have terms between 1 to 5 ages, when you find yourself a lot of time-label business loans have terms of around 25 years.

step three. Team credit line

A business credit line is a lot like a property security line of credit (HELOC), apart from the loan is for a business. A pals normally draw into line of credit as needed and pay only attract on the level of funds borrowed. The credit line was rejuvenated due to the fact financing try reduced, and fund are around for obtain again.

Credit lines are protected from the assets the firm owns otherwise unsecured and no equity support the mortgage. Interest rates and you will costs are usually all the way Mosses loans down which have a protected team credit line. Yet not, in the event the mortgage is not paid down, the lender usually takes the guarantee regularly contain the financing.