While a citizen seeking make use of the fresh guarantee you have collected of your property, now could be a time for you get a home collateral financing . Whatsoever, thanks to complications with lower supply and popular, home values expanded quickly during the last 10 years – as well as have continued to improve for the majority ount of equity to run.

Particularly, an average citizen has just below $2 hundred,000 into the tappable family guarantee to help you acquire out-of, which can be used when it comes to variety of motives, regarding debt consolidation to purchasing a moment family . And you will, when taking out property collateral loan, you will not perception your existing mortgage rate – you will be merely borrowing money which have an additional financial. Which is a good advantage to believe, particularly if you safeguarded an effective step 3% home loan speed (otherwise straight down) during the pandemic.

That being said, it’s still vital that you make an effort to have the low price you’ll be able to on the house security mortgage. Whatsoever, house collateral mortgage rates may vary somewhat considering your own borrowing from the bank profile, income, family equity levels and the lender’s underwriting conditions – so there would be a drastic difference between this new pricing you’re incorporated with other lenders. Less than, we’re going to detail what you need to discover so you’re able to lock in the newest best possible price.

Look at the borrowing from the bank first

Your credit rating is one of the chief factors always determine our home equity loan price you qualify for. While each and every bank keeps book financing recognition requirements, consumers with credit ratings above 700 will normally obtain the lower household security mortgage prices, while you are people who have score below 620 will discover higher cost – if they can meet the requirements after all.

Before applying, take a look at all of the about three of your credit history – Experian, Equifax and TransUnion – and you may dispute any errors that will be pulling your own rating off. You’ll also should reduce any revolving financial obligation for example borrowing cards to reduce their borrowing from the bank application ratio. Getting such or any other strategies to alter your credit score you may save thousands of dollars along the lifetime of the borrowed funds.

Evaluate prices out-of at the very least around three lenders

Home collateral lenders set their unique prices and you will underwriting conditions, that is why you could discover a similar debtor qualifying at the rates one disagree – will because of the more step 1% or more – regarding financial in order to lender. To be certain you get a really competitive rate, rating prices regarding at the least three additional banking institutions, borrowing unions and online lenders.

And you will, it is worth detailing that on the web lenders normally have a whole lot more easy lending requirements and will be considered consumers that get rejected by the large banks – and may even bring straight down costs for some individuals. Since you collect prices, whether or not, try to contrast brand new yearly payment rates (APRs), besides the brand new cited interest, to account fully for any financial fees or other costs that may feel rolling in the.

Think good HELOC instead

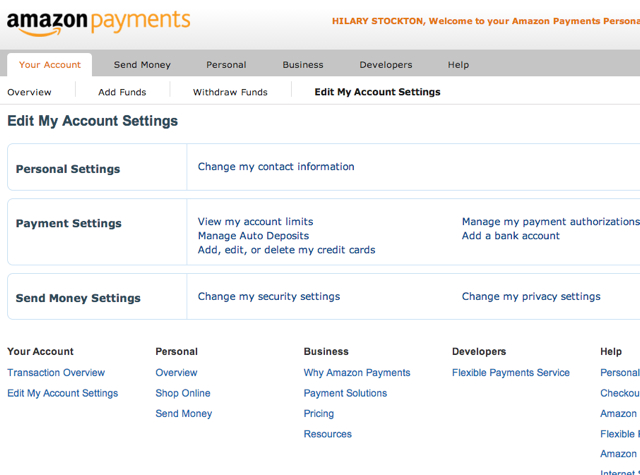

![]()

According to the preparations toward household collateral money, a property equity credit line (HELOC) may be a far greater alternative than a timeless house security loan. Which have an effective HELOC, you only pay attract on the amount you mark in the personal line of credit, as opposed to the full lump sum out of property equity loan.

HELOC cost also are variable , meaning that they’re able to go up otherwise off over the years established into large price ecosystem. Going for such domestic equity borrowing from the bank during the a frequent rates weather could be an enjoy, but considering today’s higher prices – plus the traditional one to pricing often decline will ultimately that it season – it may be a good idea to look at. At all, if you utilize a HELOC during the the current costs right after which costs belong the near future, could result in investing a lot less in the desire more than go out.

Anticipate a lesser loan-to-well worth ratio

Many lenders offer the low family guarantee pricing so you can consumers whom is tapping into a small percentage of its home’s security. Particularly, in case the residence is well worth $eight hundred,000 and also you have to acquire $100,000, your loan-to-value (LTV) proportion could be a quite low twenty five%. But when you need certainly to obtain $300,000, your LTV ratio was 75%, that will imply a higher level because there’s a whole lot more exposure so you can the financial institution.

In case your LTV ratio is actually pressing beyond the 80% tolerance therefore want to borrow americash loans locations Eutaw downtown secured on their home’s collateral, thought and make a much bigger fee to minimize it. Or if you just might should waiting two months or annually to use immediately after your monthly home loan repayments after that eliminate your loan equilibrium while increasing the security share.

Inquire about coupons

Be sure to in addition to pose a question to your possible financial on any desire rate deals they provide towards house equity financing . Such as for instance, of several lenders hit of 0.25% otherwise 0.50% for many who create automated payments out-of a bank checking account. It is possible to qualify for a speed write off should your financial you might be borrowing against your residence security that have is the identical financial that given most of your financial.

You might be eligible for a discount if you’re a great person in specific communities. Current and previous military members or first responders commonly score special domestic collateral financing savings, for example. And also a little write off adds up so you’re able to high savings along the lifetime of the house collateral financing.

The bottom line

By taking these measures, you might not simply increase your likelihood of qualifying with numerous lenders, however you could potentially get a lowered price in your domestic equity mortgage. And may build a change through the years. It just takes a slightly straight down rate – also a fraction of a % – to keep several thousand dollars into the notice over the lifetime of the loan, and may bother worthwhile whether or not it pertains to securing the very best house equity loan speed.

Angelica Einfach is elder editor to possess Dealing with Your bank account, in which she produces and you can edits articles on a range of individual money information. Angelica previously kept editing roles in the Easy Buck, Desire, HousingWire and other financial courses.