Eg a customer payday loan, a corporate bridge mortgage makes it possible to rating bucks prompt so you’re able to fulfill urgent expenses. Here’s what it is whenever it makes sense to track down that.

By: Sean Look, Factor

You really have been aware of a link mortgage for selecting a great family, however, connection financing can also be found so you’re able to companies looking to make use of a short-term mortgage whenever you are looking forward to far more long-title financial support to cover its next step. In place of a link financing, it could be hard to advances and you will build because a buddies.

If loans in Selma you believe your online business can benefit from this style of financing, you ought to see the details of that one, and gurus, cons, and you may if you should know you to definitely for your needs.

What exactly are bridge loans?

Fundera defines connection money due to the fact quick-to-financing funds one to individuals undertake to possess day-pressing expenditures on the intent so you’re able to re-finance them otherwise pay them away from rapidly due to their high priced characteristics.

Industrial or business connection funds works the same exact way because connection finance from inside the home, but they instead go for the different pressing providers costs instead of just assets.

Organizations may use bridge financing while in the wishing periods in which they have not yet acquired a lot of time-identity capital for a commercial property or other costs, including index or acquisitions.

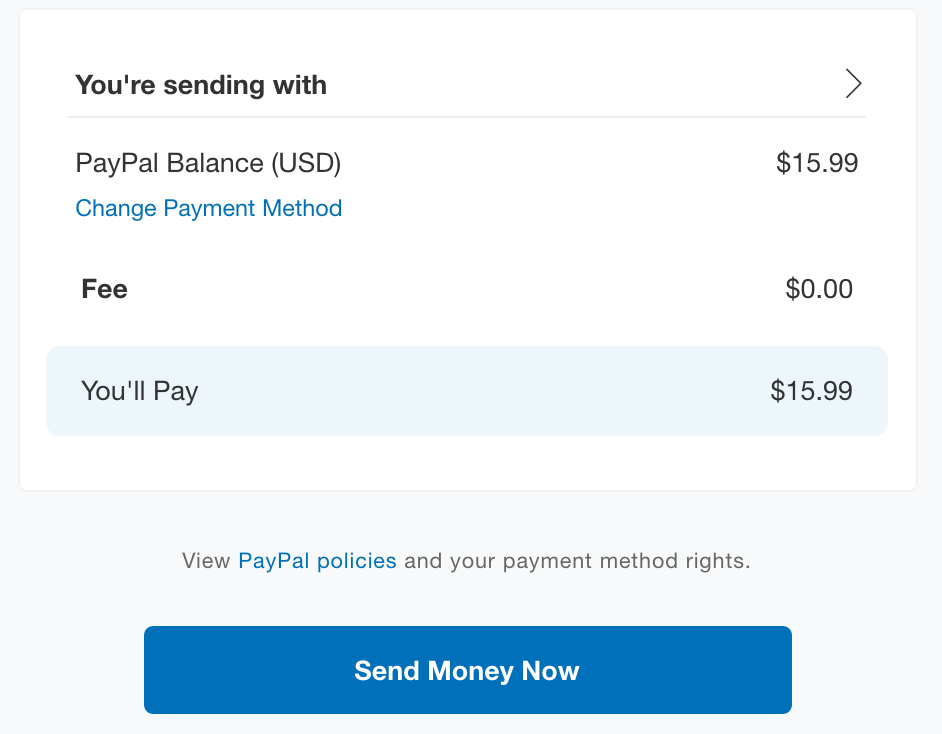

You can obtain connection loans out of difficult money lenders and you can choice loan providers, much less commonly of banking institutions or borrowing unions. You will need to get the loan to see if your qualify; and you can, if you, you’re going to get financial support usually in one month.

But not, the procedure of paying down bridge finance differs from that old-fashioned financing. As they are eg instantaneous yet quick-label options, they need brief payoff (words normally are priced between 2-3 weeks so you’re able to up to a dozen months). Nonetheless they will often have high rates than other type of money (15-24% APR), and might are specific up-front charge.

Pros and cons

Link financing feels eg lifesavers to several business owners. not, to make any choices, you need to look at the benefits and drawbacks:

- They might be small to cover. When you are approved for the financing, you can access that cash almost right away, usually in one single times. This basically means, you’ll not need hold off days towards exposure you desire today.

- They truly are small-title money. You generally afford the financing off within one year, definition it’s just not a growing burden in the rear of your attention for years to come. Once you repay it utilising the dollars increase you expect for, you may be carried out with they.

- You could prefer fees choices. Because debtor, you’re able to determine whether we would like to repay the newest financing prior to or shortly after their much time-name resource is safe. But not, this may rely on the financial institution, thus select one which fits your requirements.

- They might be tough to get. These finance be hard to secure from the mediocre lender. Concurrently, you’ll need outstanding credit and you can equity, and the lowest obligations-to-money ratio. From the precarious characteristics from link financing, lenders are specifically rigid regarding the going for out.

- They might be high priced. Link fund has actually one another highest focus and you can deal pricing. Otherwise outlay cash off in a timely manner, you’ll be able to holder right up attract quickly.

- They truly are risky. When you take out a connection loan, you’re depending on an influx of cash in order to pay-off they rapidly. If a person deal falls by way of while cannot repay the latest mortgage, possible homes yourself in sexy economic liquids.

Bridge funds feels like lifesavers to numerous entrepreneurs. But not, to make people behavior, you should check out the advantages and disadvantages.

Is a connection financing effectively for you?

There clearly was far to take on before making a decision whether to safer a connection mortgage. Very first, you can normally have having high credit, a low personal debt-to-earnings proportion and collateral of at least 20%.

If you’re approved by multiple lenders, you should comment the new regards to for each and every before you choose you to definitely. Be cautious about prepayment penalties and invisible charges; and you will take into account the incentives day offered by your own potential lenders. Specific succeed a great deal more move space although some request immediate percentage. Including, you may be expected to generate monthly payments, or even pay up-side otherwise straight back-avoid lump sum notice costs.

Additionally be interested in the risks at each angle. In case your package away from refinancing is not safe otherwise comes with the potential to slip courtesy, you may want to check out more traditional funds, such individual otherwise SBA fund.

Eventually, just you realize what is actually suitable for your business and you can exactly what level off exposure you may be safe while. If you believe a link mortgage suits you, look lenders towards you and prepare yourself to apply for an excellent mortgage.

CO- will not opinion or strongly recommend products or services. For additional info on discovering the right financing and you may funding selection, see our family during the organization.

CO- is designed to provide you with inspiration regarding leading known pros. Although not, prior to making any organization decision, you will want to demand a professional who can advise you considering your individual situation.

To keep at the top of all the development affecting your short business, find out about it for all of one’s most recent business development and you can updates.