If you are looking to own property guarantee loan during the Ny & Pennsylvania getting family renovations, medical expenses or to finance a large purchase and you can children’s degree, Artisan Financial is able to assist you with lower pricing, sensible payments and you will timely mortgage techniques.

Home equity mortgage inside into the Ny & Pennsylvania are used for repaying loans by the consolidating costs for the one low rate payment to address all mastercard highest desire financial obligation.

Whether you really have good otherwise less than perfect credit, obtaining regarding financial obligation, putting off domestic solutions, your own home’s guarantee can perhaps work to you personally which have property equity financing in the Nyc & Pennsylvania – a good way getting residents to obtain the most bucks it you prefer on a rate!

To find a head start towards techniques, call our very own experienced financing officers on (833) 844-0141, fill out the fresh new prequalification form otherwise finish the form on page to have a keen customized estimate. has been temporarily suspended until subsequent observe.

What exactly is property collateral financing and just how does it works?

Family security financing inside New york & Pennsylvania allows you once the a holder to acquire financing from the using the equity in the home since guarantee.

As residence is purchased and you also begin to generate payments, the new show of the house you possess independent regarding the financial starts to grow. The amount of money available for you in the house (the quantity maybe not owned by the financial institution) is named “equity” given that the worth falls under you.

New security includes any fund you may have purchased their house to help you get it or raise it. Because it’s a debt against at home, which you have been in actual palms of this mortgage is an effective covered debt. The house would be needed to getting offered in the event the collector wants the bucks back that you have borrowed.

New york & Pennsylvania Household Equity Loan vs Credit line (HELOC)

There’s two particular household equity loans in New york & Pennsylvania: closed-avoid loans and you can family guarantee lines of credit (HELOC). To own people exactly who meet the requirements, Artisan Financial has the benefit of closed-end money.

With a great HELOC, your availability their credit line via cellphone or of the creating monitors available with the bank. Your property protects the mortgage, and you also draw on your own credit line since you come across fit. Focus try paid back simply on what you acquire. Just as in other issues, the eye you only pay tends to be tax deductible. Please check with your income tax advisor to have info.

We provide different mortgage activities including aggressive pricing and you will settlement costs. We have about three incentives on running the loan: To give you irresistible provider, To shut your loan in a month, and to give you the better tool to generally meet their individual and you can financial requires. Please call us today to find out more. We have many different mortgage models available with competitive costs and terms. Excite get in touch with that loan manager on Artist to assist you within the trying to find a means to fix fulfill your own capital needs

We all know that your particular need are very different from anybody else’s. That is why we leave you individual, one-to-you to definitely solution. Contact us to talk to financing representative to see if this program makes sense to you. Or submit our no-obligation Consult Function. The audience is committed to providing top quality solution to our customers, whether or not you’d rather use on the internet, personally, or by e-post. With this thought, hopefully you see our website of use, and we would delight in one information otherwise comments you may possibly have.

All it takes getting a house collateral mortgage inside the New york & Pennsylvania?

With possible income tax benefits, and you can interest rates below other kinds of credit rating, family equity financing for the New york & Pennsylvania try wise payday loan Gunbarrel, effective devices that will help would one of your vital property – your residence.

- Pay back large attract personal credit card debt

- Upgrade your home, build a pool or pick a boat

- Purchase studies expenses otherwise return to school

- Enjoy and you will continue the holiday of your dreams

- Conserve from the taxation go out; the eye you have to pay tends to be tax deductible

After the ten-year months many of these programs give you the ability to possess a great 10 or twenty-year cost several months. Some of our software perform require at least initial withdrawal, therefore make sure our very own mortgage pro understand should this be important to your.

Buyers and you can Loan providers apparently change its rates and from just one date to some other, may well not remain aggressive! By having you display screen the marketplace and by “looking the rate,” we could make sure to will always getting the Ideal Prices for your kind of needs.

- Exactly how much loan would We be eligible for?

- Do i need to meet the criteria to pay off those people expenses?

Can you rating property equity mortgage for the Nyc & Pennsylvania for those who have less than perfect credit?

If you need additional information on Household Security Financing cost for the New york & Pennsylvania, delight complete the shape towards the web page. We could see ideal savings than all of our opposition and you will we have the fastest service out-of loan sources. We are following able to citation this type of savings and you will higher services onto your, our customer!

I consistently seek most of the you’ll reductions in the papers, and therefore expediting loan approvals and closings. This procedure out of operation produces greater self-reliance and you can focus on outline resulting in a great deal more comprehensive and you can specialized focus on your circumstances.

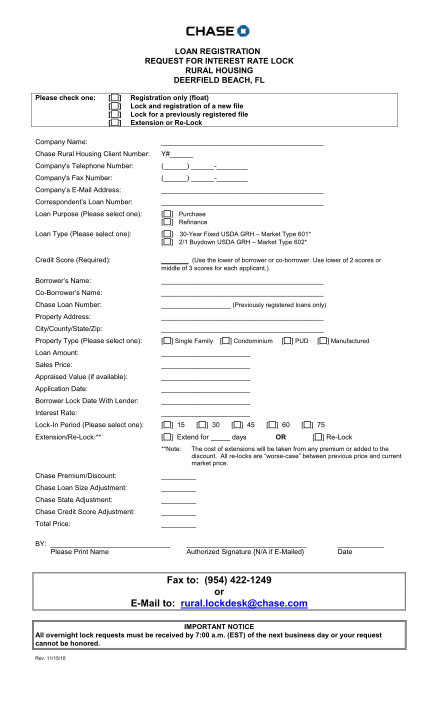

- Speed Lock

- Bad credit or Early in the day Case of bankruptcy Accepted

If you find yourself need to upgrade your property, consolidate financial obligation, or fund your kid’s education call Artisan Financial now at the (833) 844-0141 and you will let the educated mortgage officials assist you with domestic equity loans in the New york & Pennsylvania whether you are for the you are in Much time Island, Queens, Staten Island, Bronx, Brooklyn otherwise New york, Nyc.