Have to paint an effective mural on your home fast cash loan Leroy AL wall? You can do you to. Feel converting your own driveway to your an interest shop? Yep, you to also.

As well as aesthetic independence, you rating economic masters. You will be building security. Security try financing-speak on the difference between what your house is value and you can your debts for the financial. That have guarantee is a great point if you need cash getting home improvements, debt consolidation, or any other significant financial purpose.

You could borrow secured on their guarantee having a house equity mortgage otherwise house collateral line of credit (HELOC). Here are a few the best way to put a house collateral financing otherwise line of credit be effective for you.

About three reasons to acquire a great HELOC otherwise family collateral loan

Household equity fund and you will HELOCs try flexible. It’s not such as for instance getting an auto loan, that is just for a motor vehicle. As an alternative, you can choose how to make use of your mortgage locate ahead economically, centered on the concerns.

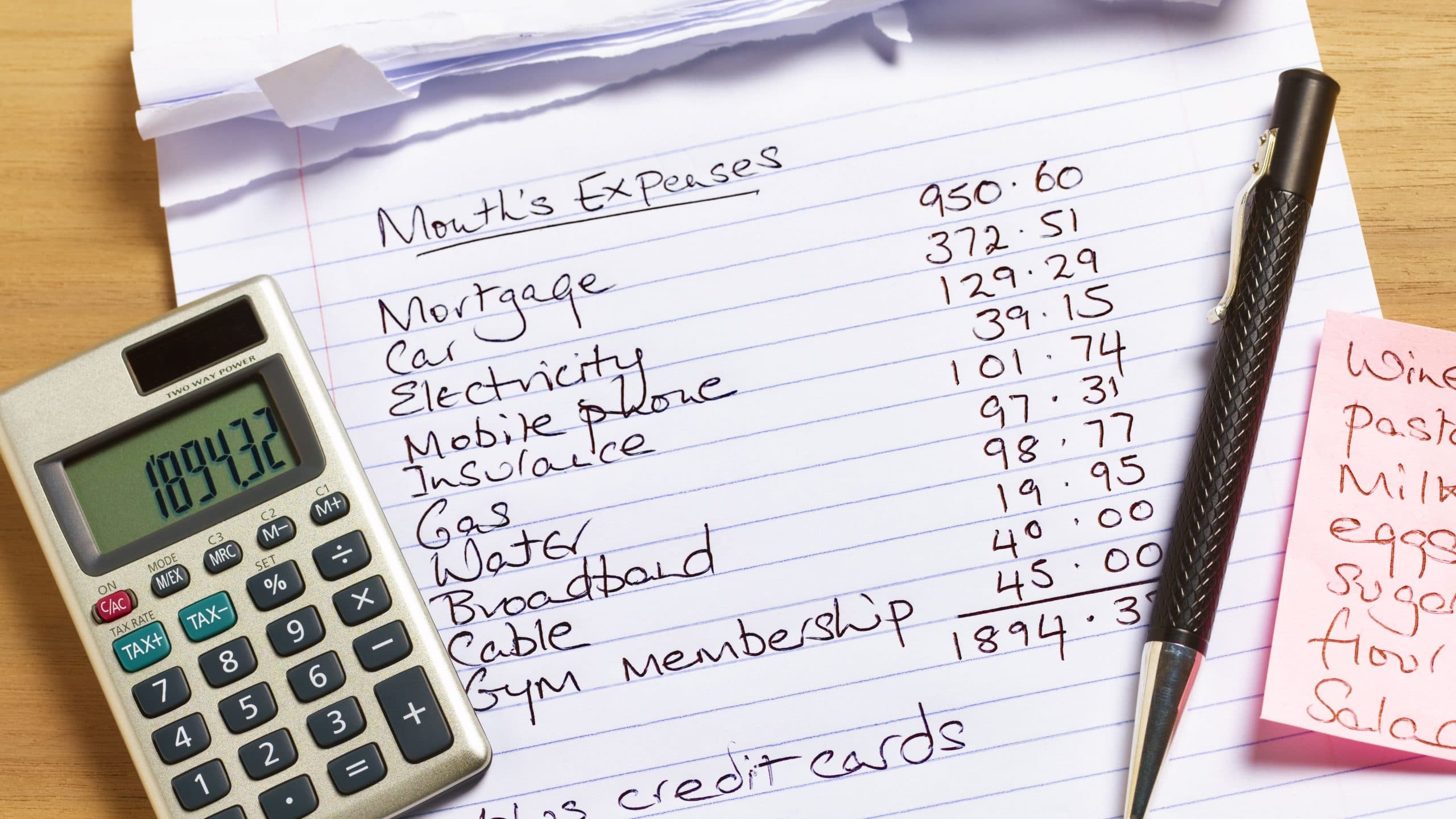

Combine personal debt

Property equity mortgage or HELOC could help pay back personal debt quicker and you can potentially save well on need for new price.

Say you may have $20,000 from inside the credit card debt within %. You happen to be faithfully using $500 on financial obligation each month however, but, it will require you 62 months (more than 5 years) to spend it well. Let-alone, you’ll pay almost $11,000 inside the desire.

If you nevertheless reduced the same $five-hundred 30 days, you could potentially spend the money for financing off inside the fifty weeks, a complete 12 months prior to. But more importantly, you would come out several thousand dollars to come. Even with the home security financing closing costs, you can save your self $5,000.

Think about what you can do into the more funds. In addition to, you could potentially clear up your bank account and reduce your stress of the combining several bills, going away from multiple monthly obligations to a single. Continue lendo “six ways to use property security mortgage otherwise HELOC”